Just how much is excessive? Crypto art market brings together deep pockets and huge artists

With the nonfungible token market approaching the frothing point, perhaps it’s time to sit back and ask: “What’s happening here?” The $750,000 in proceeds from the recent sale of a single “alien” CypherPunk NFT, after all, could have paid for a reasonably sized house.

The crypto world at large is only 12 years old, entering adolescence, but crypto art — art on a blockchain — and nonfungible tokens are just out of their terrible twos. The launch of an epoch-defining CryptoKitties goes back to 2017 and 2018, and Ethereum’s nonfungible token, ERC-721 — which is used by many digital galleries and also non-art NFTs — wasn’t developed and rolled out until early 2018. What is being discussed here is still very new.

Moreover, Bitcoin (BTC), the world’s first blockchain project, was initially just a more efficient way to transfer money, though it soon became more — a kind of social movement. In a similar vein, crypto art might evolve to be more than just another collectible. The technology behind it could make every person on the planet — not just the top 1% — owners of unique art pieces, proponents say. Or, as the winner of a crypto art auction said in December: “It’s my biggest wish for crypto to become understood as a liberating technology.”

There’s no question, though, that art — physical or digital — is also about money. The “liberating” art owner cited above has also bid $777,777 for a crypto work by artist Beeple (aka Mike Winkelmann), and it seems fair to ask in light of similar events whether the digital art market is overheating.

n emerging culture?

“It’s a bubble in the sense that capital is rapidly flying into the NFT market and much of that capital is coming from individuals who would otherwise be using that capital to invest and/or trade-in cryptocurrency,” Vladislav Ginzburg, CEO of digital art and collectible market Blockparty, told Cointelegraph. But something else is going on too, he added: “There is a real culture of collectorship emerging around NFT-backed digital art and cultural assets.”

Giovanni Colavizza, assistant professor of digital humanities at the University of Amsterdam, told Cointelegraph: “I believe we are in full price discovery mixed with rapid growth of the NFT collectibles space.” Furthermore, he added that as more wealthy individuals come into the market, the more the “creatives realize how this space can allow them to monetize their work.”

The crypto art world as presently constituted is two-fold, said Ginzburg, embracing artists who have been creating digital art from the beginning but had trouble monetizing and distributing their works — and for whom tokenization is a boon — as well as traditional, physical artists, many with significant followings but who are seeking a still larger global audience.

Justin Roiland, who just sold a crypto art piece for $150,000 at a silent auction on a Gemini-owned art platform, for example, belongs to the first group. “He is an animator — a form of digital art — who has been able to monetize his characters and animations via commercial means on a popular television show,” explained Ginzburg, adding:

“Getting into the NFT space has enabled him to stay natively digital but sell truly unique and ownable works of art without having to learn a new medium, such as printmaking.”

For traditional artists keen on adopting NFTs, “the path is less clear,” added Ginzburg, whose firm is exploring with such artists how NFTs “can support their physical works, as either an ‘add-on’ or possibly a digital extension.”

niche within a niche market

The traditional art world, where total annual transactions exceed $60 billion, dwarfs digital art, but it still remains a niche market “full of information asymmetries and all kinds of arbitrary obstacles to entry which keep it artificially small,” noted Colavizza. The NFT space, by comparison, is fully transparent and open to anyone, so it isn’t surprising that some established artists would want to test the waters, and that may have something to do with recent NFT activity.

“Several recent big drops have been due to established creatives with a follower base moving to NFT and bringing it with them,” said Colavizza, citing Beeple, who auctioned off his entire NFT collection for $3.2 million, including the single work cited above that went for $777,777, smashing Trevor Jones’ previous crypto art record by 14 times.

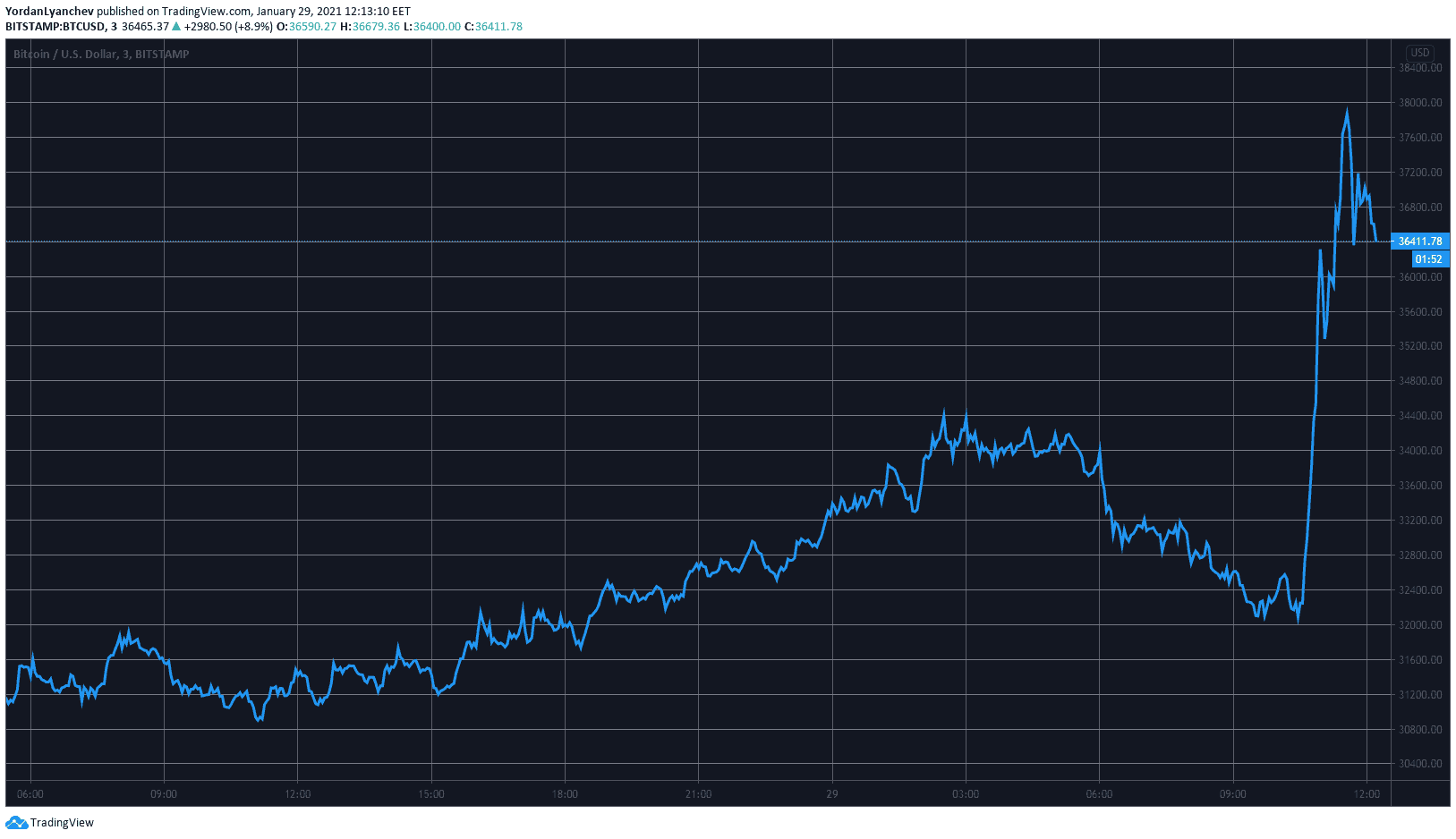

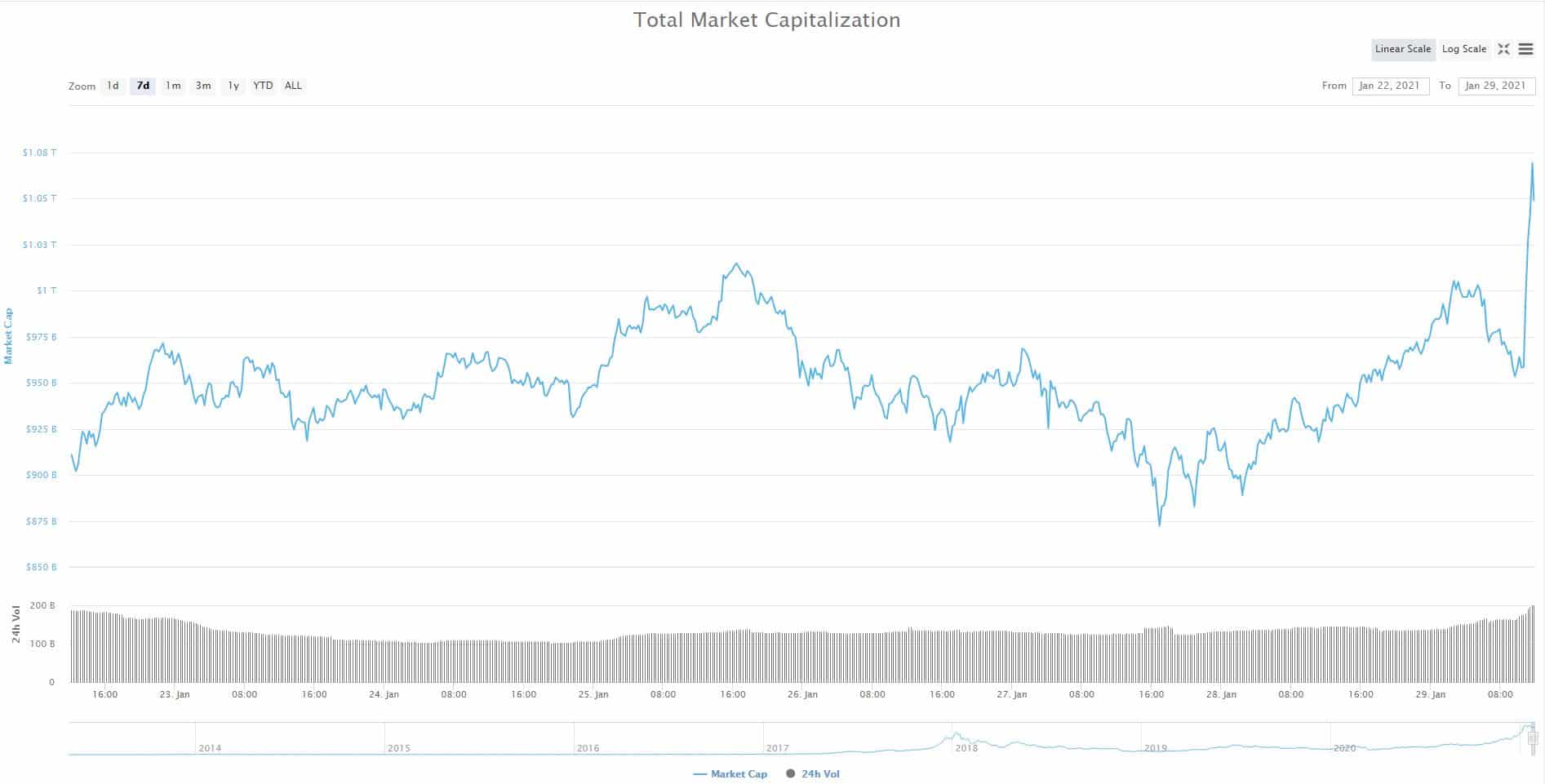

Another reason for recent activity, surely, “is the new surge in crypto,” said Colavizza. Bitcoin and Ether (ETH) reached historic highs in the past month. “Several deep pockets are being or have been made. The high liquidity means many are looking for ways to invest, and NFT collectibles are a rapidly growing space to do so.” The downside to this is higher market volatility, he added.

There might be a DeFi aspect to the NFT run as well. “Some collectors have clear plans for their collections — e.g., using it as backing for other DeFi assets or for developing estate/projects in virtual worlds,” added Colavizza. Indeed, FlamingoDAO, the crypto art collective that purchased the “alien” CryptoPunk for $750,000, announced its intent to acquire NFTs and convert them “into fractionalized works so that they can be plugged into emerging DeFi platforms, with rights to these works held and managed by a growing number of people in the Ethereum ecosystem.”

haven for speculators?

Many, of course, view this all as so much rationalizing of what is just market speculation. Misha Libman, co-founder at art marketplace Snark.art, told Cointelegraph: “There are clearly a lot more speculative purchases in the crypto space with some buyers interested in flipping the NFT tokens for profit,” surely more so than in the traditional art world. Moreover, “we are seeing a lot of emerging artists, and it is difficult to gauge where the prices reflect the quality of the artworks or where they are more driven by speculation.”

Ginzburg agreed that there was a lot of speculative money coming into the NFT market, which could leave just as quickly, but this happens in the traditional art world, too. Still, the foundation of the traditional art market is collectorship. He added:

“Pure speculators tend to be identified, isolated, and shown out pretty quickly. Collectorship keeps prices stable and the market reliably growing. This culture of collectorship is emerging in NFTs, and it’ll be exciting to see.”

Asked how crypto art prices are determined, Ginzburg answered that the basic rules resemble those in traditional art: Who are the artists? What are their backgrounds and achievements? Does their work have quality? Which collectors are interested in them or already own their work? Which galleries/platforms are showcasing their art?

“If there is one primary difference I see, it’s the new creative freedoms that digital art affords the creator,” said Ginzburg. “I would judge NFTs additionally on how many new elements they can bring together: audio, movement, physical accompaniment, etc.”

Priyanka Desai, a community representative at FlamingoDAO, told Cointelegraph that a big difference from pricing traditional art is that there “is no auction house taking a cut, it’s peer to peer,” and it’s also up to the content creators to decide when an offer will be accepted. Traditional art auction houses like Christie’s and Sotheby’s can charge commissions of 25% or higher. Open Sea, an NFT sales platform, by comparison, takes only 2.5% for sales on its platform.

Most NFT transactions are in Ether, the world’s second-largest cryptocurrency after Bitcoin. What would happen to crypto art activity if the price of ETH and/or BTC collapsed, as happened in March 2020? “It can happen in any market, and it happens in traditional art,” said Desai. In any event, the NFT market began rising well before the latest cryptocurrency run-up.

Who are the collectors?

Speculators aside, does the profile of the typical crypto art collector differ much from traditional art collectors? The crypto art buyer “tends to be young and tech-savvy. They’re already familiar with crypto, even if they don’t own any,” said Ginzburg. The market is global, but most participants are American or European, though he conceded that “this is changing very rapidly. They may or may not be art collectors, but they are definitely interested in culture as it relates to music and fashion.”

Libman told Cointelegraph: “The collectors we are seeing in this space are usually not from the traditional art world. They are generally young, educated, technology-friendly, and just like other collector markets, profess specific tastes and strategies.” As the crypto art world becomes more saturated with NFTs, they are becoming more selective, added Libman.

Related: Tokenized art: NFTs paint bright future for artists, blockchain tech

FlamingoDAO, the crypto art collective launched in October, has 55 members — all accredited investors — including “deep crypto, deep NFT people,” said Desai, but also collectors from the traditional art world who want to move into crypto art. They are a mix of ages — “even a few people over 50.”

COVID-induced fad?

Will demand for tokenized art plunge if and when the coronavirus pandemic ends and people again visit museums and art galleries? “There is no question that the pandemic has given a huge boost to the digital art market,” said Libman, but museums were expanding their digital art collections art before COVID-19, and he expects that process to continue.

“When we look across the adoption of digital format across other industries, from publishing to film and music, we believe that the expansion of the digital art market is unavoidable,” he said, adding:

“Whether the person is experiencing it on a wall or through their smartphone only changes the format. Digital allows artists to reach much wider audiences without the complications of crossing physical borders, applying for visas, and concerning themselves with various logistics.”

Will everyone own digital art?

Overall, said Libman: “The NFT art space is an emerging market, and over time, it will mature and probably resemble its traditional counterpart.” Colavizza added: “I am bullish while also conscious that volatility is high and so there will be bumps along the way.”

According to Ginzburg: “The outlook here is extremely positive, as we’re going to see some of the truly great digital artists — who have been confined to monetizing their work via commercial means — start seriously focusing on their personal artwork as a revenue generator via NFTs.”

In the future, owning unique art won’t be restricted to elites who patronize Christie’s and Sotheby’s, Desai told Cointeleraph. “Everyone will have digital art on their walls. Owning digital art will be a part of your digital (online) existence,” part of your identity, like sharing your likes in music or films over social media.

Title: How much is too much? Crypto art market brings together deep pockets and big artists

Sourced From: cointelegraph.com/news/how-much-is-too-much-crypto-art-market-brings-together-deep-pockets-and-big-artists

Published Date: Sun, 31 Jan 2021 12:47:00 +0000

2021's Most Anticipated Growth & Wealth-Building Opportunity

Join Thousands of Early Adopters Just Like You Who Want to Grow Capital and Truly Understand Cryptocurrency Together

Just how much is excessive? Crypto art market brings together deep pockets and huge artists

Check out the latest news at

NewsWireUnited.com