UK’s FCA crypto derivatives restriction might press retail financiers to riskier grounds

It has stated a variety of reasons for why the products cannot be “reliably valued” by retail consumers, such as financial crime, volatility and an inadequate understanding of crypto assets being the main ones. It was estimated that retail investors will save $53 million due to this ban. This is despite the FCA releasing a research stating that U.K. consumers have invested an estimated $2.6 million in crypto assets.

Although the main intention of this ban is to protect retail investors from the complexity of these products, the assumption that retail investors in the U.K. have an inadequate understanding of crypto assets might be incorrect. Jesse Spiro, global head of policy and regulatory affairs at Chainalysis — a blockchain analysis company — told Cointelegraph: “Given the amount of available information and market intelligence that is now regularly produced on the cryptocurrency ecosystem, there are many retail investors that have a high degree of technical expertise and knowledge.”

Derivatives growth driven by institutional investors

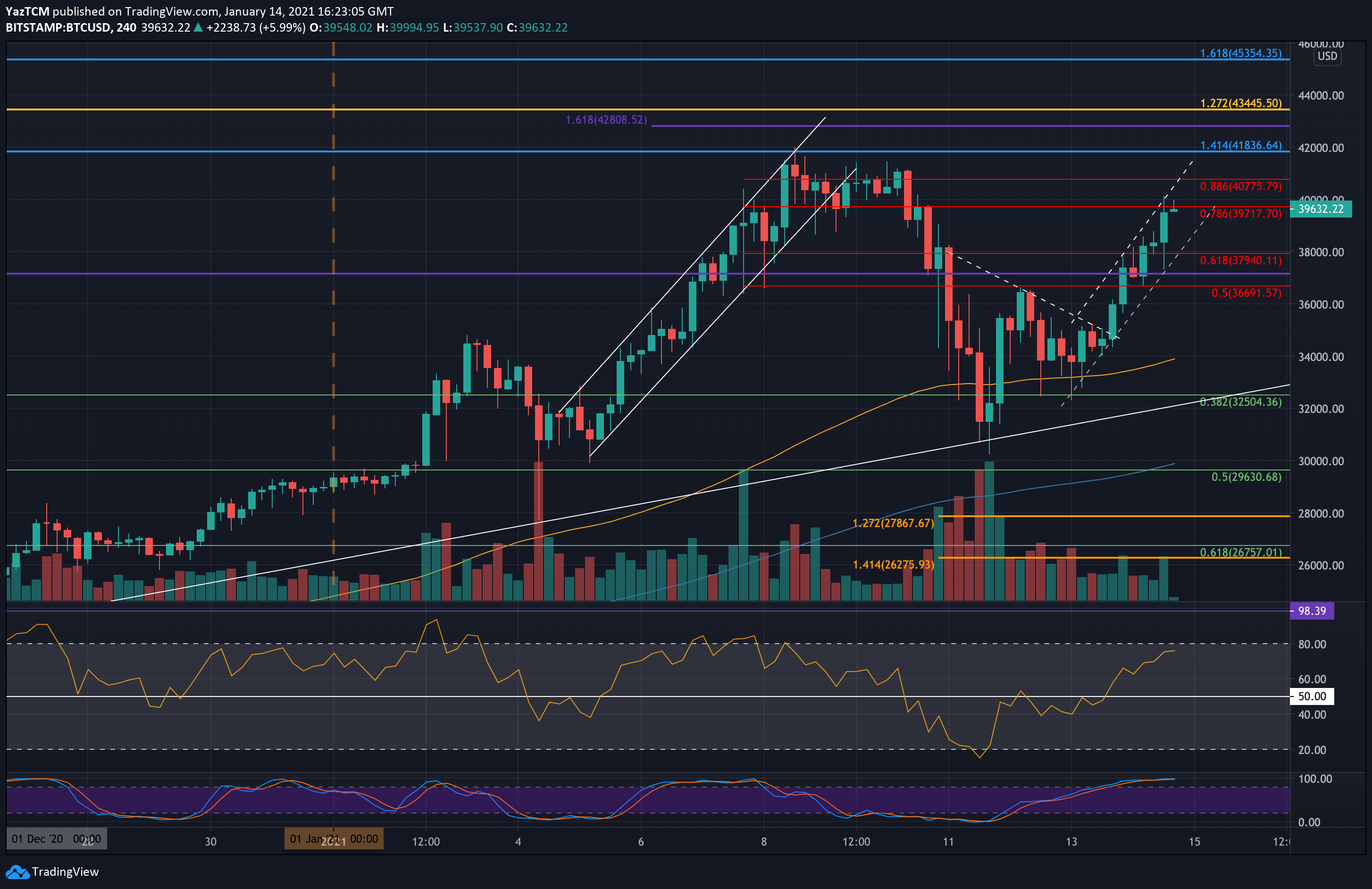

Last year saw crypto derivatives go through an enormous growth phase, where the open interest in Bitcoin options multiplied threefold in 100 days, reaching a yearly high of $6.8 billion on Dec. 31 before growing even further in early January amid a bull run, reaching an all-time high of $10.5 billion on Jan. 7. Even though this growth must include an increased interest from retail investors as well, there are several indicators pointing to the fact that it has mainly grown due to the involvement of institutional investors.

The Chicago Mercantile Exchange is one of the most important exchanges for institutional investors to give themselves exposure to digital assets through Bitcoin futures and options. The platform has reported that Bitcoin’s (BTC) average daily volume grew 114% year-on-year in 2020, which took the average daily open interest on CME up by 252%. The unique active accounts also rose to 6,700, showing an 84% growth year-on-year. The main indicator of institutional interest, the number of large open interest holders, grew to a record of 110 in December as evident from the chart below.

The United Kingdom’s Financial Conduct Authority banned the sale of crypto derivatives and exchange-traded notes to retail investors effective Jan. 9, 2021. The FCA’s main underlying reason for this is the products are “ill-suited for retail consumers due to the harm they pose.”

Jay Hao, CEO of crypto and derivatives exchange OKEx, told Cointelegraph that “crypto assets are indeed volatile as the FCA points out, and many investors have lost a lot of money when trades don’t go their way.” However, he added: “The problem is that when retail traders make a loss, they are not in a position to absorb it as comfortably as high-net-worth individuals or institutional investors.”

Regulated access to retail investors?

The reduced risk appetite of retail investors as compared to institutional investors is one of the reasons that retail investors need protection from a regulatory body. But this doesn’t necessarily mean that all retail investors are unsophisticated and that they shouldn’t have an option to use derivatives to hedge risk in their portfolio.

Haohan Xu, CEO and founder of Apifiny — a global liquidity and settlement solutions provider — told Cointelegraph: “Derivatives do more than amplify gains and losses. They also help investors hedge risks. Just because someone is unsophisticated does not mean that someone should be denied certain options to hedge risks.”

The risks in the crypto derivatives market are comparable to the risks of the foreign exchange markets, which are also highly leveraged. In these markets, governments and regulators all around the world step in and enforce maximum leverage limits for investors. The FCA could resort to solutions like that instead of a blanket ban, according to Hao:

“It is incorrect to assume that all retail investors are unsophisticated. Many of them have been in the crypto space for a long time and have a very good understanding of digital assets. Rather than a blanket ban on crypto derivatives for retail traders, which adds an additional layer of gatekeeping to the crypto space, we believe that education is key.”

Another issue that a blanket ban brings up is that retail investors who are persistent in investing in these banned products will need to circumvent this rule and invest in markets that are not under the FCA’s protection. Hao further stated: “These investors would be outside of the purview and protection of the FCA — which is obviously counterproductive.”

Xu alluded to another method to circumvent the ban using decentralized finance markets, which have seen 30% growth since the beginning of this year: “Although not favored by regulators across the world, DeFi derivatives platforms are always an option for crypto derivatives since most of them can be accessed by anyone from anywhere with just a wallet.”

It seems evident that there might be a better solution than a blanket ban, as it could possibly do more harm than good at this point, leading U.K. investors to marketplaces with no regulations or to lowering Know Your Customer standards, which brings more risk to retail investors who don’t have the same safeguards as institutional ones.

Retail education and regulatory engagement

Even after announcing the blanket ban on crypto derivatives and exchange-traded note products, Bitcoin’s price drop to $33,000 on Jan. 11 led FCA to issue a public warning about the high risks underlying all crypto assets and assets linked to them. The agency has also stated: “If consumers invest in these types of products, they should be prepared to lose all their money.”

Hao elaborated on how education would be a more effective method to protect retail investors than outright bans: “Education is key, and giving investors the chance to demonstrate their level of knowledge and skill before accessing complex products is crucial.” He further stated: “Unfortunately, if retail investors are forced onto exchanges with lower security standards in virtual asset storage, they could end up suffering more harm from this ban.”

The crypto community has been contributing to these initiatives on education by establishing points and platforms for retail investors to be educated of any risks that are involved in trading within leveraged derivatives markets. Various exchanges have education and blog sections on their website tailored for retail investors to educate them on all these aspects. There are also exclusive blockchain and cryptocurrency education platforms, such as Blockchain Education Network, which was started by students at the Massachusetts Institute of Technology and the University of Michigan.

It’s also essential for the crypto community to engage with governments and regulatory bodies to establish frameworks that enable retail investors to navigate these markets with ease. Spiro stated: “The regulators’ priorities lie in protecting the financial ecosystem and consumers. Working collaboratively is the best way to pacify regulatory concerns while avoiding onerous regulation.”

Due to the size and volumes of the U.K. retail market in comparison to the global crypto derivatives market, it is highly unlikely that this ban will have a significant impact on the accelerated growth of the crypto derivatives that continues into 2021. According to Hao:

“The directional growth of derivatives is clear, and it will surpass the spot market in the near future. Exchanges have clients based all over the world, and as interest in cryptocurrencies rises, the jurisdictions that are more open and understand how best to regulate will end up being the winners in this race.”Title: UK’s FCA crypto derivatives ban may push retail investors to riskier grounds

Sourced From: cointelegraph.com/news/uk-s-fca-crypto-derivatives-ban-may-push-retail-investors-to-riskier-grounds

Published Date: Thu, 14 Jan 2021 12:23:49 +0000

UK’s FCA crypto derivatives restriction might press retail financiers to riskier grounds

Check out the latest news at

NewsWireUnited.com